Contents

Eventually, after interval t2, the CA stability reverses path and begins to extend—in other words, a commerce deficit falls. The diagram demonstrates clearly how the CA stability follows the sample of a “J” in the transition following a greenback depreciation, hence the title J-curve principle. Immediately following the depreciation or devaluation of the currency, the whole worth of imports will increase and exports remain largely unchanged due partly to pre-current commerce contracts that need to be honored. Over the long term a depreciation in the exchange rate can often be expected to enhance the current account balance. Domestic consumers swap to home merchandise and away from the now more expensive imported items and services.

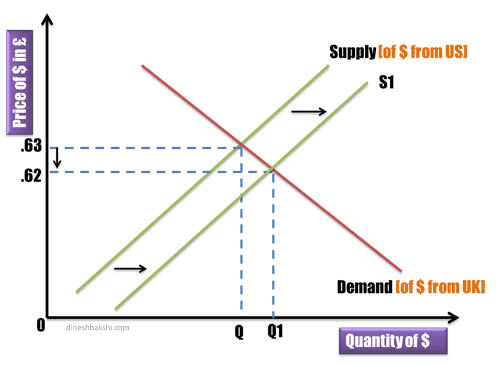

When the forex of a rustic appreciates, its exports will become costlier inflicting a decline in them, whereas its imports will turn out to be cheaper leading to increase in them. As a end result internet exports of the nation will decline leading to the lower in net exports and can due to this fact trigger leftward shift within the mixture demand curve AD as is shown in Fig. 28.6 where as a result of increase in net exports mixture demand curve shifts to the best. As a result, given the quick-run combination supply curve the levels of GDP and worth stage will increase.

- There happens to be a lag between the response and devaluation on the given curve.

- Likewise, the fall in prices for export products did not immediately stimulate volume more significantly.

- A current account surplus is a positive current account balance, indicating that a nation is a net lender to the rest of the world.

- Thus, as several months and years move, the results from the modifications in quantities will surpass the price impact caused by the dollar depreciation and the CA steadiness will rise as proven in the diagram after time t2.

- A country’s trade balance is the amount of goods it is selling abroad, exporting, minus the amount of goods it is buying from abroad, importing.

The export elasticity of demand is due to this fact low within the brief run, however will be greater in the long term. Of brief run or long term, the period during which the J-curve theory predicts that a rustic’s trade deficit will fall with a foreign money depreciation. A cheaper domestic currency means lower-priced exports in the global market, and dearer imports, which initially makes trade surpluses smaller or deficits bigger.

At this point, individuals are most likely to engage in collective revolutionary activity. Since the greenback depreciation causes imported items to turn into more expensive to U.S. residents, the quantity of imported goods demanded and purchased will fall. Eventually, the fund will start to experience unrealized gains, followed over time by events in which the investment gains, such as initial public offerings , leveraged capitalizations, and M&As .

Contents

Please consider your specific investment requirements before choosing a fund, or designing a portfolio that suits your needs. Over the long haul, large numbers of foreign consumers may bump up their purchases of products that come into their country from the nation with the devalued currency. These products now become cheaper relative to domestically-produced products.

Returns begin to increase as the investment fund lives, starting to become a more mature portfolio. The necessary concept of exponential development is that the population development fee, the number of organisms added in every reproductive technology, is accelerating; that is, it’s increasing at a higher and larger rate. After 1 day and 24 of those cycles, the population would have elevated from one thousand to greater than sixteen billion.

In the short-term, firms and consumers may have contracts to keep buying the good. The Asian financial crisis was a series of currency devaluations and other events that spread through many Asian markets beginning in the summer of 1997. An L-shaped recovery is a type of economic recession that, when it recovers, resembles an “L” shape in charting.

How the J curve works in international trade

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. The J-Curve is also often applied to a private equity fund’s calculation of return on investment. This is because a weaker currency makes the country’s goods cheaper compared to other countries and, conversely, other countries’ goods more expensive compared to domestic products. A country’s trade balance is the amount of goods it is selling abroad, exporting, minus the amount of goods it is buying from abroad, importing.

The cashflows in this graph are based on several assumptions, are for illustrative purposes only and cannot be relied upon. The timing and amounts of actual cash flows can vary widely from this illustration and there is no guarantee of performance results. Manager skill – The skill of the manager can also affect the shape of the J-Curve.

Trade starts in perfect balance, but depreciation at time 0 causes an immediate trade deficit of 50 million dollars. The balance of trade improves over time as consumers react, returning to balance at month 3 and rising to a surplus of 150 million at month 4. Just like for trade-balances, the J-curve in private equity illustrates how the benefits of changes are often not felt until later in time. Similar applications have been found in political science, country economic status and medicine. It represents the scenario that initially, the fund poses negative returns, but with time, it will provide higher positive returns. Private equity investments are typically riskier than other types of investments.

The concept of the J Curve serves to be a tool that is made use of across several fields. For instance, in the field of private equity, J Curve can be used for demonstrating how private Equity Funds ushered traditionally in negative returns after the starting post-launch years. However, later on, they started experiencing the gains after finding the respective footing.

What is ‘J-curve effect’ in Economics?

Gross domestic product is the monetary value of all finished goods and services made within a country during a specific period. A J Curve is a line graph that resembles a letter J, with an initial decline followed by a strong rise. At the same time, consumers at home begin to buy more locally-produced goods because they are relatively affordable compared to imports. A J-curve depicts a trend that starts with a sharp drop and is followed by a dramatic rise. Full BioRobert Kelly is managing director of XTS Energy LLC, and has more than three decades of experience as a business executive. He is a professor of economics and has raised more than $4.5 billion in investment capital.

In the middle and later years of a fund’s life the manager will begin to mark up its portfolio investments as their business plans bear fruit. As these portfolio company mark ups begin to reverse the initial markdowns, the fund’s overall performance ear spy super hearing should shift from negative to positive as the J-Curve is achieved. In economics, the ‘J curve’ is the time path of a rustic’s commerce steadiness following a devaluation or depreciation of its foreign money, beneath a sure set of assumptions.

It due to this fact follows that internet impact of devaluation on the balance of commerce could go both method. The historical expertise exhibits that initially the adverse impact predominates. The Marshall–Lerner condition (after Alfred Marshall and Abba P. Lerner) is satisfied if the absolute sum of a rustic’s export and import demand elasticities is bigger than one. The given set of parallel actions is known to shift the given trade balance. This helps in presenting smaller deficit and increased surplus in comparison to the figures before the process of devaluation.

Balance of trade is the net value of imports & exports of goods, services, and investments of a country. So, the J-curve results from the effects on the Balance of Trade when the currency in the economy is devalued. When the currency is devalued, the trade deficit will initially worsen and eventually improve in the long term. It requires several high costs, such as legal fees, accounting, taxes, and management fees. Since the allocation and diversification of investment are gradual, it does not immediately result in a massive cash inflow. When a private equity commitment is made, the value of the commitment typically goes down during the early life of the fund.

The J-curve in private equity tends to be more pronounced in the United States compared to the United Kingdom and Western Europe. This is because private equity firms in the US tend to carry their investments at investment cost or the lower end of market value, and are generally more aggressive in writing down than writing up investments. The definition and meaning of a J-Curve is a type of graph, shaped like the letter ‘J’ – illustrating the trend of a nation’s trade balance immediately after its currency has been devalued. Currency devaluation impacts the cost of imports and exports in the short run. In such a scenario, the import of goods or services becomes expensive, and export becomes cheap.

Balance of trade model

Also, foreign traders will purchase more products that are being exported to their country. The products exported to their country are relatively cheaper due to the weakened currency value. At this stage, the country experiences the desired outcome of improving the current account balance. The J Curve forms when the country’s currency depreciates and the value of exports becomes less expensive than the value of imports.

In private equity, the J curve is used to illustrate the historical tendency of private equity funds to deliver negative returns in early years and investment gains in the outlying years as the portfolios of companies mature. The steeper the positive part of the J curve, the quicker cash is returned to investors. The J-curve effect suggests that after a currency depreciation, the current account balance will first fall for a period of time https://1investing.in/ before beginning to rise as normally expected. If a country has a trade deficit initially, the deficit will first rise and then fall in response to a currency depreciation. On the opposite hand, the rupee- worth of imports will increase instantly after devaluation. Imports into India from abroad can be more pricey as a result of because of devaluation a hundred rupee notice will buy fewer US dollars and pound sterling’s than before.

For example, existing export contracts must expire and already purchased and imported goods must be used before a response to the currency depreciation happens. One of the essential factors that one should consider while understanding the J-Curve is the impact of greater price elasticity in the long term. The Dramatic Gain Phase – The phase where the curve surpasses the initial investments and reaches the stage of absolute returns. J-curve is a graphical representation depicting an initial loss followed by gains that surpassed the starting point in long-term taking the shape of the same alphabet. Here, the line first falls and then gradually starts rising and keeps rising above the starting point.

Equally, many foreign consumers may switch to purchasing the products being exported into their country, which are now cheaper in the foreign currency, instead of their own domestically produced goods and services. J curve in private equity is a graphical representation of the returns of a private equity fund over a period of time. These early times are also referred to as the investment period- during this time, the investment manager attempts to source companies to acquire for the fund. Once this is done, the effort is to add value to the acquired businesses by putting into action the business plans that would later impact valuations. In the mid-period and later, the manager will mark up its portfolio investments as the business plan bear fruit; thus, the Internal Rate of Return begins to grow, and the investment becomes profitable.

A devalued foreign money means imports are dearer, and on the belief that the volumes of imports and exports change little at first, this causes a fall in the present account . After some time, although, the amount of exports begins to rise because of their lower price to international consumers, and home shoppers purchase fewer imports, which have become costlier for them. Eventually the commerce steadiness strikes to a smaller deficit or larger surplus compared to what it was earlier than the devaluation.